FINANCIAL PLAN

Revenue Model

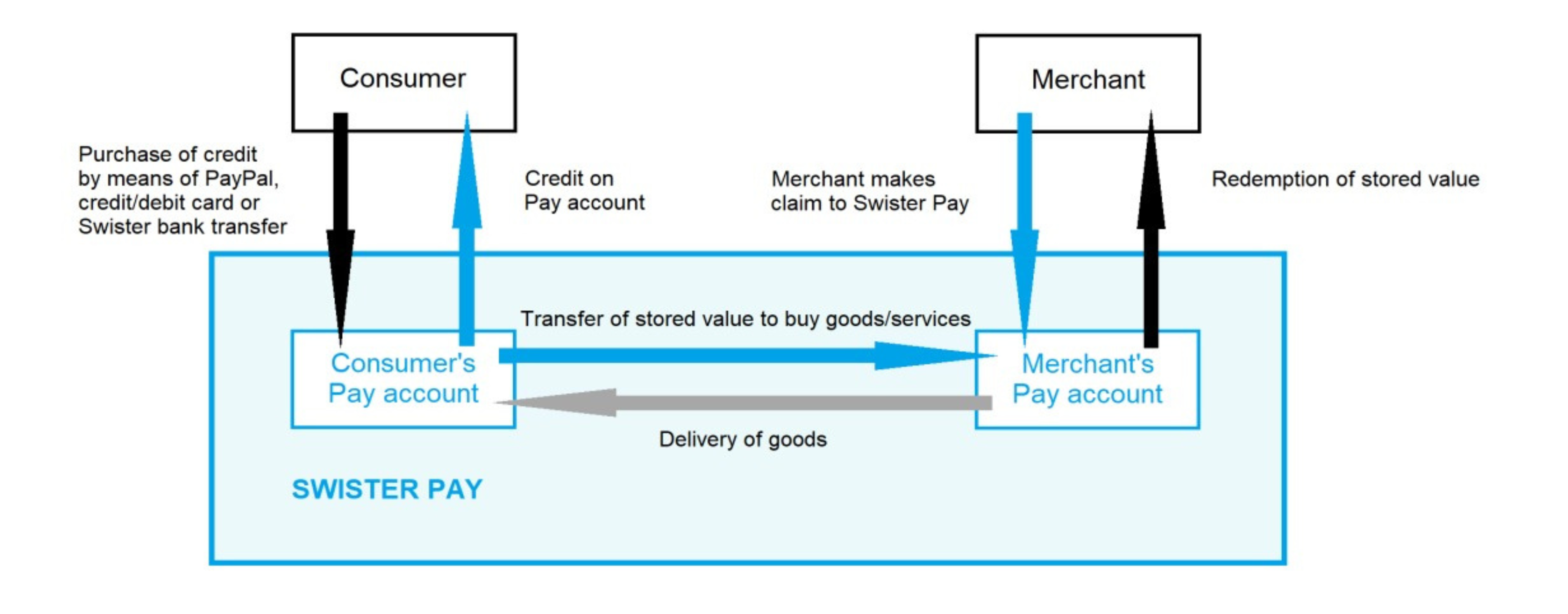

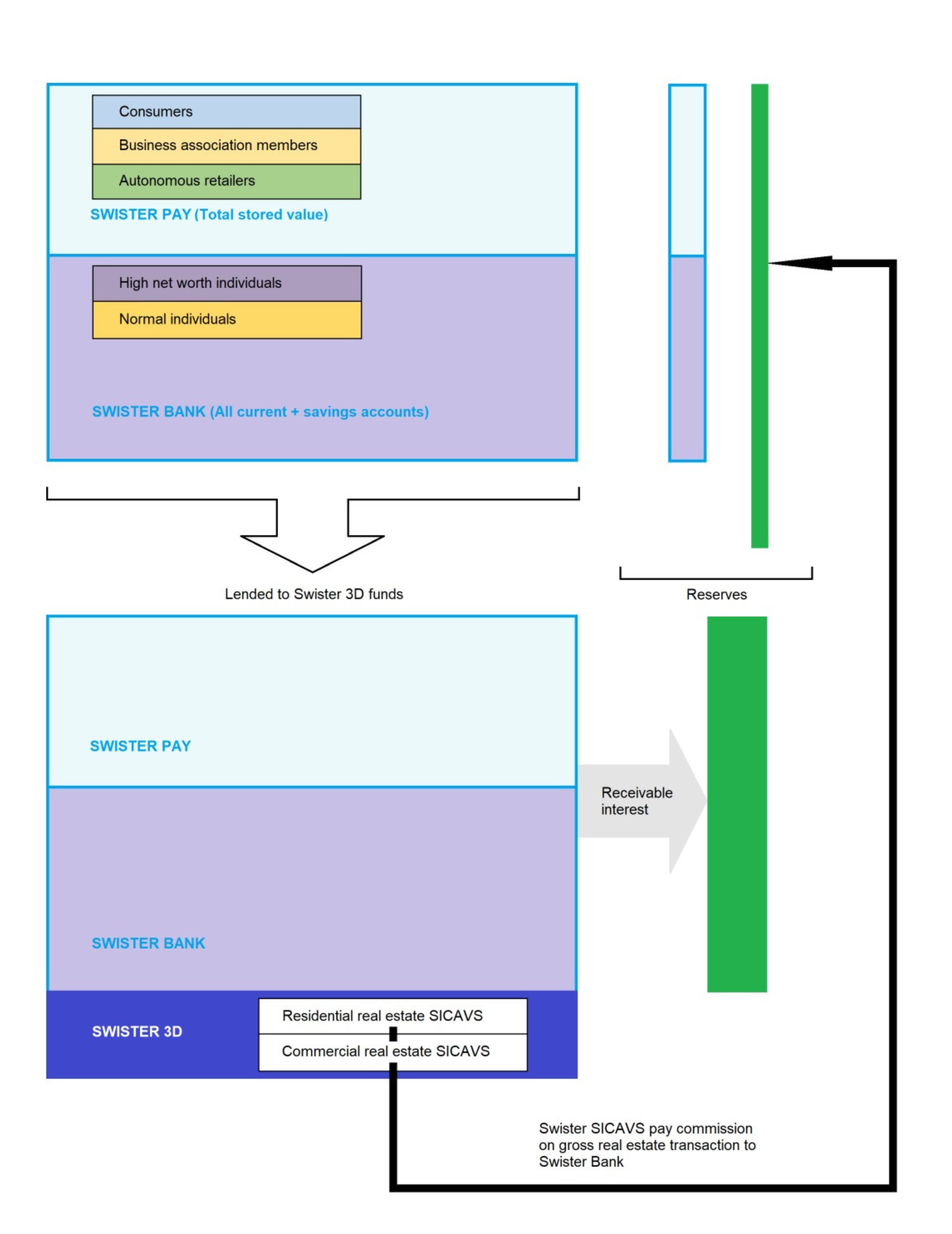

Swister’s revenue primarily comes from its Swister Pay platform, akin to PayPal, eBay, and WhatsApp, gathering savings from users and merchants. 45% of these savings stem from platform transactions, with the rest from direct clients, mainly affluent individuals. The bulk of these funds (95%) is invested in Swister’s luxury real estate ventures across diverse markets, with a small portion (5%) reserved for risk management and liquidity. The self-financing aspect of the real estate funds, where shareholders contribute 22.5% through the 3D application, bolsters Swister’s revenue model, ensuring sustainability and income diversification.

Swister Bank generates revenue in 2 manners:

- Core banking activity:

This primarily revolves around the import of collected savings, assets, and Assets Under Management (AUM). Unlike traditional banking, Swister’s liabilities and assets are composed mainly of client deposits and loans, respectively, deviating from conventional industry classifications. Key metrics are extensively detailed to assess the soundness of the lending activity, maintaining fidelity to banking terminology and model. This approach ensures a comprehensive understanding of Swister’s financial plan, catering to both industry professionals and non-specialists alike.

- Other Banking Activity / Real-Estate Funds:

This includes real estate funds known as Swister 3D SICAVS, which bolster the bank’s assets under management. These funds are raised through the Swister 3D application, constituting an average of 22.5% of the total real estate investment. Revenue for the bank from these SICAVS amounts to 2.00% of the gross investment.

- Non-banking activity:

Swister’s non-banking activity involves selling its systems and providing services to third-party entities such as credit unions, brokers, mid-size and small businesses, and corporations engaged in trading or interested in establishing their own payment systems.

Financials Statements

Projected Statement of Profit and Loss

Particulars (in € ‘Mn) | 2025 | 2026 | 2027 | 2028 | 2029 |

Revenue | 5 | 12.9 | 25.1 | 43.2 | 66.3 |

Y-O-Y Growth % | – | 158% | 95% | 72% | 53% |

Cost of Sales | 0.9 | 2.7 | 5.4 | 9.5 | 14.6 |

Gross Profit | 4.1 | 10.2 | 19.7 | 33.7 | 51.7 |

Margin % | 82% | 79% | 78% | 78% | 78% |

Business Expenses | |||||

Salaries | 2.6 | 3.5 | 4.3 | 4.8 | 5.8 |

Others | 1.4 | 4.8 | 10.6 | 19.9 | 33.2 |

Total Business Expenses | 4 | 8.3 | 14.9 | 24.7 | 39 |

Net Profit | 0.1 | 1.9 | 4.8 | 9 | 12.7 |

Margin % | 2% | 15% | 19% | 20% | 19% |

Gross Equity from Banking Activity

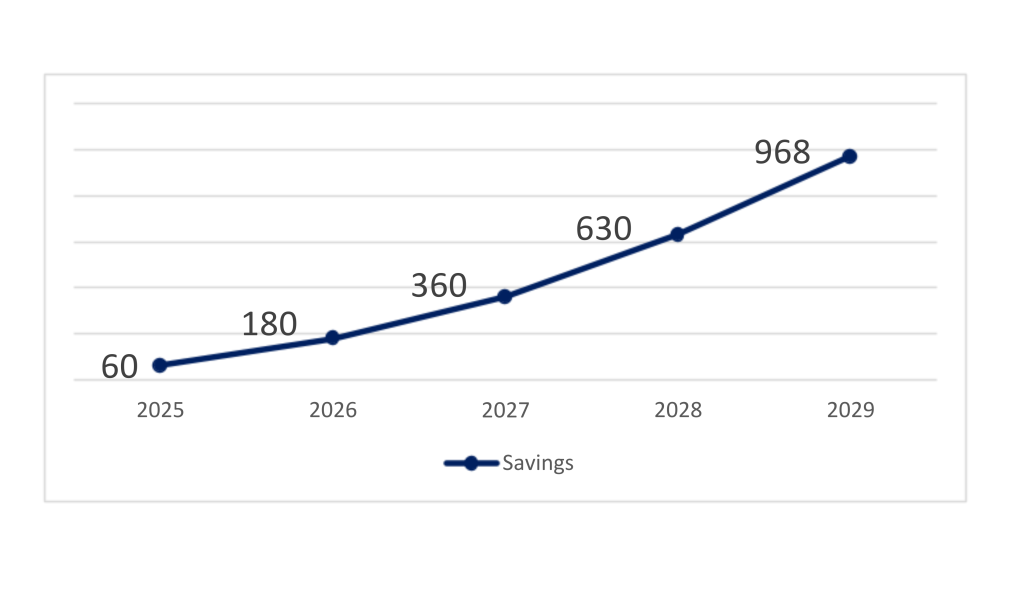

Particulars (in € ‘Mn) | 2025 | 2026 | 2027 | 2028 | 2029 |

Assets | 60 | 182 | 366 | 641 | 986 |

Liabilities | 60 | 181 | 364 | 637 | 980 |

Equity | -0.03 | 0.65 | 2.32 | 4.41 | 6.86 |

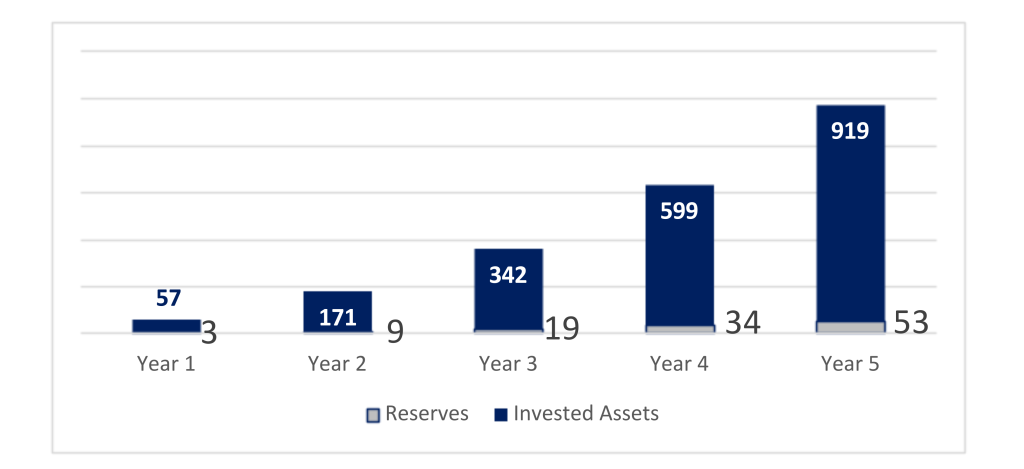

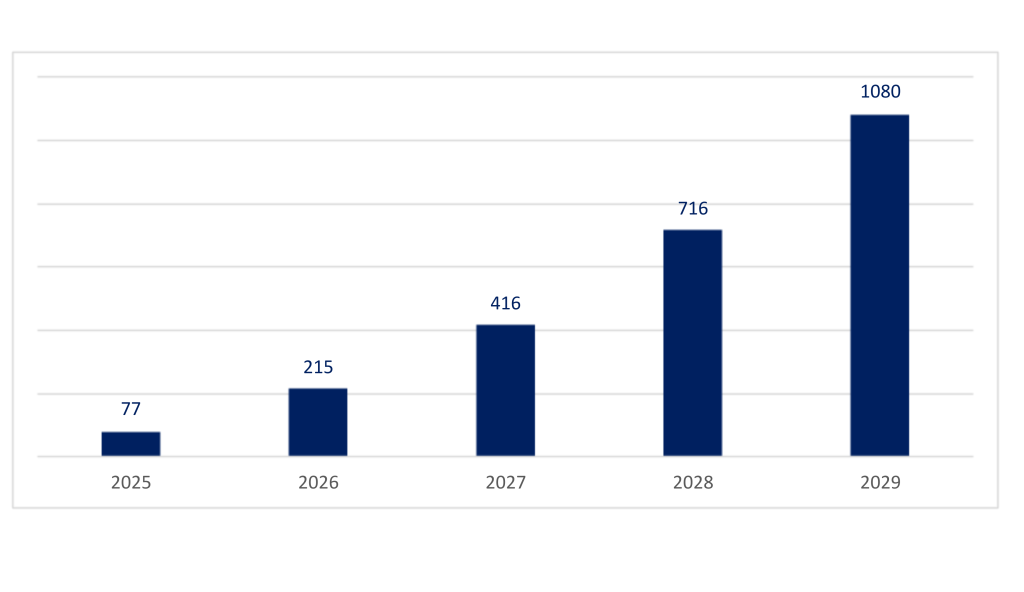

Assets Under Management

Amount in € Mn

THE OFFERING

- Application:

- Technical listing of EUR 2.128.381,39 Founder Shares.

- Tradable listing of USD 29.754.600,00 Investor Shares, subject to prior private placement of USD 1,000,000 Investor Shares at least. The Investor shares are offered at the initial offering price of the USD equivalent of EUR 200,00 per share, which corresponds with a 15,48% reduction based on the USD spot price on the date of technical listing approval.

- Issued and Outstanding Share Capital

- Share Capital Composition: The Company’s share capital, as of the date of this Investor Memorandum, comprises 223,25 Ordinary Shares (of which 222,72 Ordinary Shares with a nominal value of EUR 95,00 per share and 53 Ordinary Shares that have been issued at a price of EUR 236,63) resulting in a total issued capital of EUR 2.128.381,39.

- Listing Status: The existing shares are technically listed directly and are not admitted to the DCSX market for trading.

- Exclusion from Private Placement: The existing shares do not form part of the private placement offering.

- To be Issued Share Capital:

- Private Placement Offering: Private Placement Offering: The Company will initially conduct a private placement to offer up to USD 29.754.600,00 Investor shares.

- Share Price: The offering price per (cumulative preferred) share will be the USD equivalent of EUR 200,00.

- Listing Approval Requirement: The private placement is conditional upon the approval of the technical listing application by the Listing Committee of the DCSX.

- Share Rights: The rights attached to the shares, including any distinction between founder and investor shares, will be determined by their respective share class (ordinary or cumulative preferred shares).

- Listing Price:

The (cumulative preferred) share price of EUR 200,00 per share has been established further to an equity share valuation report dated May 21st 2024, carried out by an external auditing firm (LG), albeit subject to a pre-listing discount of 15,48%.

- Rights Attached to the Securities:

Below is a summary outlining the principal rights associated with the Shares. This summary is not comprehensive and should not be considered as a definitive statement of shareholders’ rights and responsibilities. Investors are advised to seek independent legal counsel if they require a detailed statement or have any uncertainties regarding their legal status.

- Attendance at General Meetings: shareholders have the right to attend general meetings of the Company either in person or through a proxy, attorney, or representative, as outlined in the Articles of Incorporation and the Curaçao Civil Code.

- Voting Rights: Each holder of Ordinary (or Founder) Shares possesses voting rights and may exercise them in person or by proxy, attorney, or representative.

- Dividend Entitlement: Directors may declare dividends to be paid to entitled shareholders in proportion to the number of Shares they hold on the record date determined by Directors. Interim dividends may also be paid at the discretion of Directors. shareholders are entitled to dividends subject to the provisions of the Listing Rules and the Curaçao Civil Code.

- Shareholder Liability: Shares issued under this Information Memorandum are fully paid, absolving shareholders from any further financial obligations to the Company.

- Transferability of Shares: Shares are generally transferable, provided the transfer complies with formal requirements and legal regulations without contravening laws of Curaçao or breaching the Listing Rules or the Curaçao Civil Code.

- Variation of Rights: The Company may vary or abrogate the rights attached to Shares with the approval of a special resolution passed at a shareholders’ meeting. In the event of different classes of Shares, variations require consent from holders of three-quarters of the issued shares of that class or by special resolution passed at a separate meeting of the holders of that class.

- Amendment of Articles of Incorporation: Amendments to the Articles of Incorporation necessitate a special resolution passed by at least three-quarters of shareholders present and voting at a general meeting, preceded by at least 28 days’ written notice specifying the proposed resolution.

- Indicative timetable of principal events

Submission of the Application incl. this document to the DCSX | No later than August 23rd 2024 |

Subscription period open | Upon approval of the technical listing |

Subscription period first close | At the discretion of the Company’s management |

Confirmation & payment instructions to subscribers | Within 5 business days after subscription |

Payment subscribers | Within 15 business days after payment instructions |

Financial closing | At the discretion of the Company’s management |

Trading start | After tradable listing approval, expected no later than September 19th 2024 |

All references to time in this Document are to Atlantic Standard Time (AST) unless stated otherwise | |

- Statistics:

Number of shares issued and paid-up pre-admission to the DCSX | 22.325 |

Maximum total number of Investor Shares issued conditional to Listing approval & subscription | 518.411 |

Offering price per Investor share | USD equivalent of equivalent of EUR 200,00 |

Estimated gross Proceeds | USD 29.754.600,00 |

Estimated transaction cost including promotion | USD 607,000,00 |

Estimated Net Proceeds of Placing receivable by the Company | USD 29.147.600,00 |

- Opening and Closing Date for Subscription:

- Investors are invited to subscribe for Investor shares, with the Company retaining the right to accept or reject subscriptions in whole or part, and to close the subscription books at its discretion, without prior notice. The initial closing of the Offering is scheduled 30 days after the commencement of the Offering, or as otherwise determined by the Company.

- Subscribers agree to become shareholders of the Company upon subscribing, as detailed in this Prospectus, and are not entitled to rescind their subscription agreement, subject to legal provisions. If Investor shares are not admitted to the DCSX for any reason, subscribers will receive a full refund of their principal investment, with applicable bank and broker charges remaining in effect.

- Subscription fees

- The Company does not impose any subscription fees, unless specified otherwise by the Board. However, participating authorized brokers may charge fees for their services.

- Rationale for the offering and utilization of proceeds

- The Company, a forward-thinking fintech startup, aims to leverage software/system modules for various banking activities, including E-Wallet functionality and closed community communication features. Pending the incorporation of subsidiaries, contingent on successful capitalization, the system will cater to internal banking and investment needs. Additionally, the software will be licensed to third parties, including credit unions, securities brokers, payment service providers, and trading platforms.

- To kickstart its business plan, as well as to build up reserves and increase its capital adequacy ratios in order to expand its banking business in the next two years, the Company is seeking additional investment of up to EUR 27.671.600,00 beyond the EUR 2.128.381,39 contributed by Founder Mr. Camerlinckx. Prioritizing enhanced profile, adherence to corporate governance practices, and preparation for future capital rounds, the Company has chosen scrutiny by the Dutch Caribbean Securities Exchange (DCSX), a supervised internationally recognized securities exchange with access to European, North, and South American markets. Listings on the DCSX are typically denominated in USD.

- The breakdown of capital sources:

Sources | Amount in USD |

Equity Contribution Founder | 2.288.582,14 |

Share Capital Raise | 29.754.600,00 |

Senior Debt Bank | 0,00 |

Junior Debt Bonds | 0,00 |

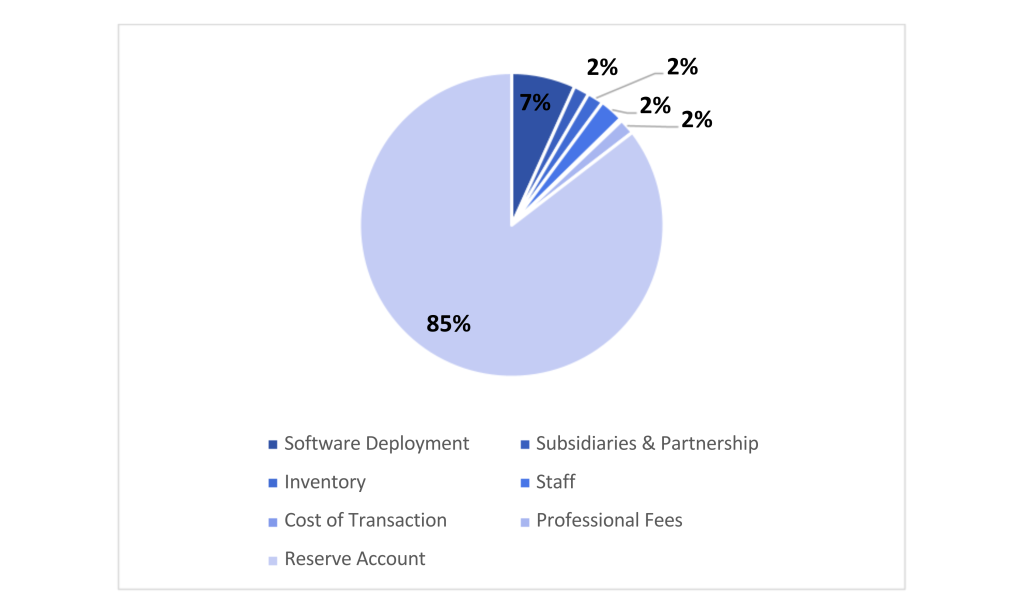

- The breakdown of the deployment plan for: USD 32.043.182,14

- Minimum Proceeds Requirement:

In order to effectively develop the Company’s business, it is essential that the Offering generates a minimum net amount of proceeds totaling USD 250.00,00. This minimum funding threshold will facilitate the completion of software development, initiation of system module licensing, and establishment of operational activities as a Fintech entity in [Switzerland or other specified location].

- Future Capital Raises:

To sustainably fuel growth while upholding robust capital ratios, the bank plans to execute an additional 4 capital injections between 2025 and 2028. Contributions of additional capital in kind (natura) are not currently included in the financial plan but may be considered in the future.