EXECUTIVE SUMMARY

MARKET OPPORTUNITY

In today’s dynamic financial landscape, the demand for innovation is skyrocketing. Swister leads the charge, ready to address challenges faced by both traditional institutions and emerging fintechs. While legacy players struggle with outdated technology and high costs, fintechs face barriers in reaching high-net-worth individuals due to perceptions of low-cost services. Swister offers a comprehensive suite of financial services, catering to diverse needs across individuals, businesses, and institutions.

With cutting-edge technology and visionary strategies, Swister surpasses traditional banking limitations. From specialized investment opportunities like its 3D funds focusing on luxury real estate to the seamless payment experience of Swister Pay, the company exemplifies financial innovation. Additionally, Swister’s commitment to developing innovative financial products like consignable and fissionable savings accounts demonstrates its dedication to meeting modern consumer needs.

As the fintech industry surges towards a projected $1.5 trillion market by 2030, Swister emerges as a beacon of opportunity. With a broad target market across various regions and demographics, Swister has immense growth potential. By capitalizing on key growth drivers such as digital adoption, consumer trust, and regulatory changes, Swister is poised to solidify its leadership in the global financial services sector. With a steadfast focus on innovation, customer-centricity, and market expansion, Swister is set to redefine the future of finance.

COMPANY OVERVIEW & PRODUCT

Swister disrupts finance with innovative fintech solutions, led by Swister Pay, akin to PayPal but with unique features. This e-wallet efficiently manages funds, directing them to specialized 3D real estate investments across Italy and emerging markets. Leveraging its trading system, Swister secures hedge fund interests and uses real estate to create exclusive lounges for HNW investors. Beyond investments, it offers modern financial systems like consignable savings accounts and Swister Voice, an alternative communication platform. Swister’s commitment to innovation is evident in its technical features, ensuring a user-friendly experience.

Corporate Structure:

Swister operates under Swister N.V., consisting of three wholly-owned entities. Swister AG and Swister Ltd, joint ventures between Swiss and EU fintechs, hold a 50% economic interest. “EU+” covers the European Economic Area and additional nations. Casa Swister S.p.A., a wholly owned subsidiary, manages customer lounges and supports subsidiaries.

EXECUTION

Swister’s execution plan encompasses key activities focused on product development, marketing, customer acquisition, value proposition, traction, and cost leadership.

- Product Development: Swister has achieved a TRL of 8, showcasing real-world success. With autonomous operations and full control over source code, it ensures scalability and agility. Its internal IT team enables rapid development and deployment of new finance applications.

- Marketing Plan & Customer Acquisition Strategy: Swister utilizes various marketing strategies, such as Swister Lounges for wealth managers, cross-pollination between apps, and collaboration with shop owners. Sales channels like roadshows and industry networks aim to expand the investor base for 3D funds. The commercial approach focuses on a hub-and-spoke model, triple leverage strategy, and strong financial model executed by Tier 1 bankers and asset managers.

- Value Proposition: Swister offers a comprehensive financial framework, advanced software systems, an extensive network of fund and wealth managers, a focus on High-Net-Worth (HNW) clients, and eliminates commissions through Swister Pay, forming its value proposition.

- Traction: Despite being pre-revenue and having only an MVP, Swister has made remarkable strides. It has refined product development, protected intellectual property through SIAE, and gained recognition for its team’s expertise. With strategic partnerships and a clear go-to-market strategy, Swister is positioned for future growth.

Cost Leadership: Swister achieves operational efficiency through maximum vertical integration, minimal reliance on external intermediaries, streamlined processes, and commercial efficiency optimized through data leverage and internal tool development.

FINANCIAL PLAN

Swister’s diverse revenue model is primarily driven by the innovative Swister Pay platform, accounting for 45% of the savings pool, with high-net-worth individuals contributing significantly. These savings fund Swister’s 3D real estate funds and core banking activities. Unlike traditional banks, Swister’s liabilities are mostly client deposits, with loans as assets. Additional revenue comes from real estate funds and non-banking activities like selling systems and services to credit unions, brokers, and small businesses.

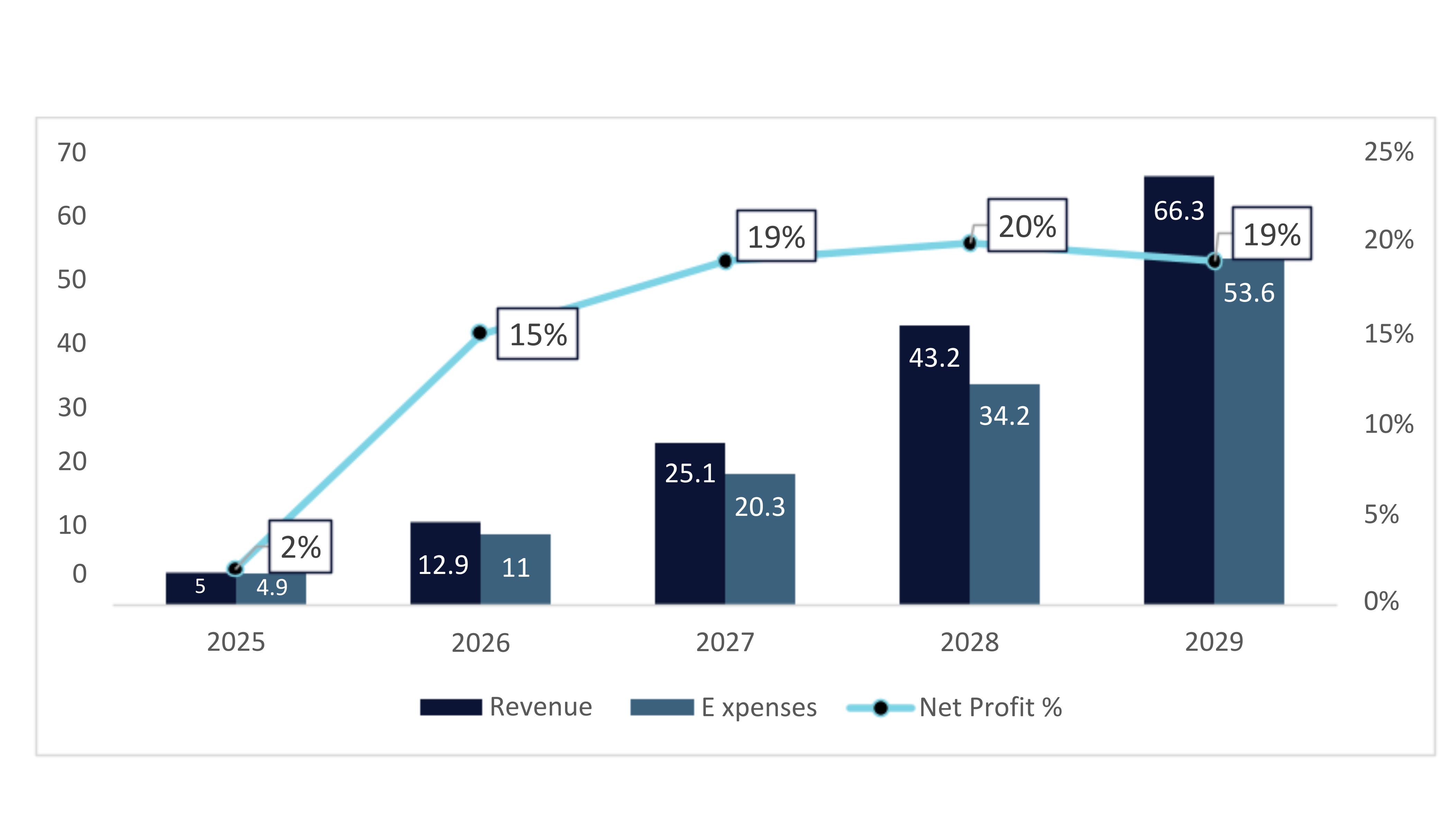

Projected financials show substantial growth, with revenue expected to rise from €5 million in 2024 to €66.3 million by 2028. Gross profit margins are high at 78%, and net profit is projected to reach €12.7 million by 2028, demonstrating Swister’s financial strength and growth potential.

- Revenue Model:

Swister’s revenue model centers on Swister Pay, a platform like PayPal and WhatsApp. About 45% of savings come from Swister Pay transactions, with the rest from high-net-worth individuals. Most savings (95%) are invested in Swister’s 3D real estate funds, with a small portion for risk management. Additional revenue comes from core banking activities and real estate funds like Swister 3D SICAVS

5 Year Financial Projections: