COMPANY OVERVIEW

Overview

Swister revolutionizes finance with its innovative solutions, notably Swister Pay, a payment system akin to PayPal but with unique features. It efficiently manages investment funds, directing them into Swister’s 3D funds, specializing in luxury real estate across Italy and emerging markets. Swister secures minority interests in hedge funds and uses acquired real estate to create exclusive lounges for High-Net-Worth investors, showcasing strategic wealth management.

Expanding its offerings, Swister introduces cutting-edge financial systems like consignable and fissionable savings accounts, alongside multi-layer current accounts, catering to diverse financial needs. Additionally, Swister Voice, a unique communication platform, breaks traditional barriers by enabling users to connect using personal identification items. Such versatility enhances user experience and amplifies Swister’s reach in the competitive fintech landscape.

Mission

Swister’s Mission is fourfold:

- Striving to surpass the current benchmarks of Instant Messaging (IM) platforms in every aspect of economic value.

- Building Swister’s distinguished reputation as the premier provider of advanced financial technology (Fintech) solutions.

- Maintaining the team’s youthful energy and enthusiasm.

- Spreading the ethos of corporate integrity to all Swister customers and users.

In other words, Swister will at all times adopt a five-star service, or rather five stars followed by the “S” that distinguishes the Savoy from other upscale hotels, or Sonderklasse sedans from other automobiles.

Vision

- For the investor:

To optimize profitability and to rank within the industry’s top 7 percent of worth-the-value investments.

- For the customer:

To offer absolute protection and maximum privacy, together with a minimum of administrative hassle.

- For the colleague:

The guarantee that his or her selection was based on merit, and not on woke-imposed quota. Pride and immense satisfaction.

Product

Swister is transforming finance with its innovative suite of solutions. Swister Pay, similar to PayPal but with advanced features, acts as a multi-user e-wallet, streamlining transactions and consolidating investment funds. Accompanied by 3D funds specializing in luxury real estate investments and innovative savings products, Swister offers diverse opportunities for portfolio growth. Swister Voice, an alternative communication platform, ensures secure connections using various personal identification items, enhancing user experience. With state-of-the-art features and a commitment to innovation, Swister is poised to redefine banking and investment.

- Swister Pay: Functioning as a multi-user e-wallet, Swister Pay is akin to PayPal but with advanced features tailored for consolidating investment funds. It ensures seamless transactions while maintaining robust capital ratios.

- Swister’s 3D Funds: These collective investment schemes specialize in luxury real estate ventures across Italy and emerging markets. Managed by Swister’s advanced trading system, they offer investors portfolio diversification and leverage Swister’s expertise.

- Savings Products: Swister offers innovative financial products such as consignable and fissionable savings accounts, along with multi-layer current accounts. These cater to individuals seeking modern banking solutions, providing flexibility and convenience.

- Swister Voice: This unique application transcends traditional communication platforms by enabling users to connect using 16 different personal identification items. It ensures secure and versatile communication and serves as a potent marketing tool for promoting Swister’s financial products.

State-of-the-Art Technical Features: Swister impresses users with its advanced technical features, facilitating seamless transactions and innovative functionalities. From facilitating payments between vehicles to implementing top-notch security measures, Swister ensures a user-friendly and secure experience for its customers.

Ownership & Structure

Corporate Structure:

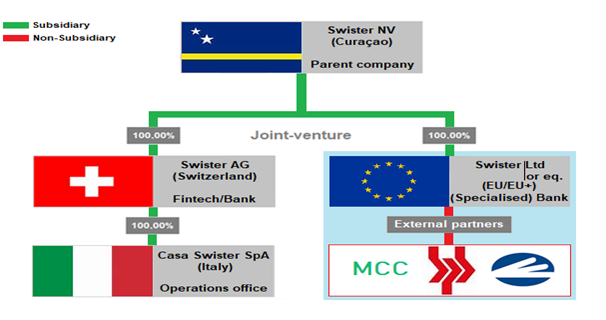

As a group, Swister’s corporate structure will be composed of four entities: Curaçao-based parent company Swister N.V., as well as three subsidiaries:

- Swiss-based Swister AG: A fintech company that is due to operate under FINMA (Swiss Financial Market Supervisory Authority) regulations.

- EU-based Swister Ltd: Either a “Specialized Bank” or holder of a similar (light banking) license issued by a European state (which may be a non-member state that is covered by a multilateral agreement with the EU). In absence of its own license, this subsidiary will conduct its business on a so-called BaaS-basis (under the license of an affiliated party).

- Italian-based Casa Swister S.p.A.: A subsidiary of the Swiss entity that will not offer financial services as such, but provide technical and other support to the former.

For the purpose of the present IM and, more specifically, Swister’s financial forecast, all projected values refer to the consolidated activities of Swister AG and Swister Ltd.

The banks whose logos appear in the scheme below (Mediocredito Centrale, Banca Popolare di Bari and Cassa di Risparmio di Orvieto) have been identified as potential commercial partners for the distribution of Swister’s retail products. However, any such collaboration will be considered optional rather than required.

Swister’s Corporate Structure

Management Team

(Including the Board of Directors and Supervisory Board)

- Geert Camerlinckx – Founder and Executive Director

Having his background in economics, he is the developer of the Company’s financial software applications. Prior to the foundation of the Company he was the Government of Gibraltar’s representative in Italy. From 2011 to 2014 he, and his company (Camerlinx Ltd), were charged by Gibraltar’s Ministry of Trade & Development with the execution of the country’s social housing scheme that involved the construction of over 1.100 residences. Subsequently, his project featured 7th on the Italian parliament’s (2013) list of largest inward investments.

He is also the founder and so far the sole owner of Swister S.r.l. (Italy), the Rome-based company that is expanded upon under the sections “Third Party Transactions” and “Swister S.r.l.”. Swister S.r.l. was incorporated with a capital of EUR 5.000.000, which is the highest to date amongst all companies that have been registered with the Roman Chamber of Commerce during the course of this year. (Source)

- Prof. Franceso Mazzuca – Executive director

Both as a scientist and manager he has reached the absolute top at national and European level. As a nuclear science professor and NASA project manager he headed a team that was charged with the development of rocket engines in the 1980s. He was subsequently nominated as Italian representative to the European Space Agency and one of six Directors of the Ariane (spacial launch vehicle) programme. Later he became member of the board of Finmeccanica (now called Leonardo), one of the world’s leading aeropace and defence conglomerates with just over 50.000 employees. More recently he held the position of CEO of Ansaldo Nucleare (a leading manufacturer of power plants) and government commissioner of SOGIN (operator of the Italian power plants).

- Dr. Laura Falato – Head of the Supervisory Board

After obtaining her doctor’s degree first in accountancy and later in finance, she specialised in fiscal law. Since the mid-1990s she owns her own auditing firm (Falato) and is also a senior partner in a leading law firm (Consulia). During the course of the last two decades she has been appointed crisis manager and receiver/trustee of several medium-to-large cap companies. She is also the current statutory commissioner (and as such board member) of football club Napoli (Naples), winner of multiple national and European titles/cups.

- Jim Bousaid – Member of the supervisory board

He is a Dutch economist who returned to his native Suriname to become CEO of the country’s largest financial institution (Hakrinbank) and president of the National Bankers’ Association. Up until this present assignment he acted as government commissioner for the Central Bank. He is also the president of the supervisory board of Staatsolie, the national energy, oil and gas company. In this quality, but also previously as an executive, he may considered a key negotiator behind Staatsolie’s mega-deal (USD 9 billion) with Total Energies.

As depicted in the table below, the Company adopts a governance structure that is divided into a board of directors (de facto management board) and a supervisory board. The former is subdivided into shareholders and non-shareholders. The latter is subdivided into ordinary and independent members, as per criteria expanded upon under principle 3 of the section “Corporate Governance/Corporate Governance Policy”.

Board of Directors ( Management B | |||

Executive directoard)ors | Non-executive directors | ||

1 | Geert Camerlinckx | 1 | Prof. Franceso Mazzuca |

2 | See Note | 2 | Dr. Stefania Freddi |

3 | See Note | ||

Supervisory board | |||

Ordinary members | Independent members | ||

1 | Dr. Laura Falato (President) | 1 | Jim Bousaid |

2 | See note | 2 | See note |

Note | |||

The positions referred to are to be filled in by persons that are nominated in consultation with new investors in accordance with principle 3 of the section “Corporate Governance/Corporate Governance Policy”. | |||

The supervisory board appoints the CEO who, in consultation with the former, shall be in charge of a five-tier management structure in accordance with the table below:

Tier 1 |

|

Tier 2 |

|

Tier 3 |

|

Tier 4 |

|

Tier 5 |

|

The CEO shall be appointed further to an (extraordinary, or general if in conformity with the deadline referred to below) shareholders’ meeting, within 30 days after the Company’s listing on the DCSX (or other listing venue if applicable). The nomination process shall be conducted in accordance with, and (in the unlikely event of ambiguity) in the following order of precedence:

- The Company’s Deed of Incorporation

- The present Investor Memorandum on the basis that its Listing Particulars (or similar technical sections), including those (indirectly) referred to, prevail over its commercial and strategy-related aspects.

Director’s Terms of Employment (including members of the supervisory board)

The directors and members of the supervisory board will be under remuneration contract with the Company for an initial term of one year that is however renewable. The contracts include a termination clause based on a six months prior notice for both parties, subject to the next paragraph.

In case of a material breach of contract, the supervisory board can elect for dismissal without notice.

Provided that the financial position of the Company so allows, the directors and members of the supervisory board will be remunerated in accordance with the table below:

Directors | |||

Executive directors(1) | Non-executive directors(2) | ||

Import (EUR) | 120.000 per annum | Import (EUR) | 36.000 per annum |

Payable | on monthly basis | Payable | per trimester |

Supervisory board | |||

Ordinary members | Independent members | ||

Import (EUR) | 24.000 per annum | Import (EUR) | 24.000 per annum |

Payable | per trimester | Payable | per trimester |

Notes | |||

| |||

| |||

For the avoidance of confusion, the above remuneration scheme does not apply to the Company’s statutory director PYGG B.V.

Subject to all applicable provisions and to the extent of reasonableness, the supervisory board will determine the remuneration of the CEO, as well as that of other managers.

The Shares

The founders of Swister N.V. currently possess all shares, distributed in the following manner:

Name | Position | Class of shares | Number held |

Pygg B.V. | Statutory director | Ordinary | 1 |

Geert Camerlinckx | Statutory director | Ordinary | 22.324 |

The above-mentioned shareholders may or, in the case of Geert Camerlinckx, be likely to transfer their shares or part thereof to a management company, trust of fiduciary, whether or not before the completion of the IPO. They (or he) will however remain the ultimate beneficiary owner.

SWOT Analysis

The SWOT analysis provides us with an excellent opportunity to examine and evaluate the internal strengths and weaknesses of our product. It also allows us to focus on the external opportunities presented by the business environment as well as potential threats.

- Strengths:

- Exceptional Customer Experience: Thorough understanding of the customer journey ensures consistently positive interactions and heightened satisfaction.

- Targeted Niche Marketing: Effective niche marketing aligns offerings with specific customer needs, providing tailored solutions.

- Sales and Service Culture: The organization nurtures a culture focused on effective sales and service practices, leveraging valuable customer database information.

- IT/Software Expertise and Agility: Leveraging advanced IT expertise, the company operates efficiently and adapts swiftly to market changes.

- Personalized Support: Prioritizing personal service, the company provides attentive support and demonstrates in-depth understanding of niche market dynamics.

- Successful Online Channels: Utilizing various online channels, including successful online sales channels, the company engages customers effectively and expands its reach.

- Proficiency in Digital Marketing: With expertise in digital marketing, the company enhances brand visibility and engagement across digital platforms.

- Market Knowledge and Customer-Centric Strategy: Possessing strong market knowledge, the company embraces a customer-centric strategy, driving long-term relationships.

- User-Friendly Products: The company develops easy-to-use products, anticipating high levels of customer loyalty through satisfaction with functionality and usability.

- Weaknesses:

While strengths are advantageous, acknowledging weaknesses is beneficial. We have pinpointed several weaknesses:

- Product Gaps & Limited Investment Range: The company’s lack of key financial offerings such as loans and mortgages, coupled with reliance solely on own SICAVs, restricts its ability to meet diverse customer needs and offer alternative investment options, potentially hindering revenue streams.

- CRM Program Depth: The current Customer Relationship Management (CRM) program’s lack of depth impacts customer retention, satisfaction, and overall relationship management, posing challenges to long-term growth.

- Cap on New Customers: Imposing caps on new customers based on liabilities may hinder the company’s ability to acquire new business and expand its customer base, restricting potential growth opportunities.

- Limited Market Share & Economies of Scale Development: Struggling to gain significant market share indicates challenges in competing effectively, while inadequate development of economies of scale limits cost efficiency and competitiveness, potentially impacting profitability and growth.

- Marketing-Mix Model Utilization: Insufficient utilization of marketing-mix models hampers the company’s ability to optimize marketing strategies and effectively allocate resources, potentially limiting customer acquisition and revenue growth.

- Technology Adaptation Obligation: Keeping pace with rapid technological advancements requires significant investment and resources, potentially straining finances and diverting focus from strategic priorities.

- Market Follower Tendency & Strong Competitors Presence: Being a follower in the market may result in missed opportunities for differentiation and competitive advantage, particularly against strong competitors, impacting profitability and growth.

- Emerging Entrants Competition & Broad Competitive Set: The presence of numerous emerging entrants and a broad competitive set complicates the landscape, requiring careful positioning and differentiation efforts to stand out and maintain market relevance.

- Weak Bargaining Power & Limited Market Access: Limited bargaining power with BaaS providers may result in unfavorable terms and conditions, while restricted market access beyond strongholds hampers growth potential and diversification efforts.

- Opportunities:

Leveraging strengths and recognizing weaknesses aids in seizing emerging opportunities. These opportunities encompass, among other things:

- Broaden Geographic Reach: Expanding into new regions to tap into untapped markets, increase customer base, and diversify revenue streams.

- Expand Product Mix: Introducing new products or services to cater to a wider range of customer needs, enhancing competitiveness and revenue potential.

- Customer Journey Mapping: Identifying pain points in the customer journey to optimize interactions and enhance customer experience, improving satisfaction and loyalty.

- CRM Program Elaboration: Enhancing the CRM program to improve retention rates and strengthen customer loyalty.

- Pursue Greater Economies of Scale: Expanding or improving efficiency to achieve cost savings, improved competitiveness, and enhanced profitability.

- Cross-Functional Team Collaboration: Fostering collaboration and innovation through cross-functional teams to improve organizational performance.

- Develop Customer Relationship Culture: Building a customer-centric culture to emphasize satisfaction and loyalty, driving long-term relationships and revenue growth.

- Customer Database Data Mining: Using data mining to gain insights into customer behaviors and preferences, enabling targeted marketing and personalized experiences.

- IT/Software Expertise Enhancement: Continuously improving IT/software expertise to remain competitive and leverage technological advancements.

- Digital Marketing Expertise Acquisition: Building digital marketing expertise to effectively use digital channels for customer acquisition, engagement, and retention.

- Online Comparison Website Advertising: Advertising on online comparison websites to increase visibility, attract potential customers, and drive traffic.

- Key Sponsorships Utilization: Using key sponsorships to broaden brand exposure and enhance reputation, driving customer acquisition and loyalty.

- Design Iconic Swister Lounges: Creating iconic Swister lounges to offer unique, premium customer experiences and differentiate the brand.

- Threats:

It’s important to remain vigilant of potential threats, which may include:

- Dependence on Social Media: Heavy reliance on social media for marketing may miss key customer segments, especially if not aligned with High Net Worth (HNW) preferences.

- Excessive Cost of Big Data: High costs of big data collection and analysis limit the company’s ability to leverage data-driven insights for strategic decisions.

- Dependence on New Product Development: Overreliance on new products for revenue growth risks missed opportunities and revenue shortfalls if product launches fail or delay.

- Becoming a Me-Too Player: A generic product mix reduces differentiation, making it harder to attract and retain customers, leading to pricing pressures.

- Weakening Customer Relationships: Declining customer relationships and satisfaction lead to higher churn rates, reduced repeat business, and negative word-of-mouth.

- Declining Share-of-Customer: Customers allocating a smaller portion of their spending to the company reduces revenue potential and increases vulnerability to competition.

- Inflexible Internal Processes: Rigid internal processes hinder adaptability, innovation, and responsiveness to market changes and customer needs.

- Being Leap-Frogged by Competitor’s Technology: Competitors surpassing the company in technology erodes competitive advantage and market share.

- Emerging New Entrants: Many new competitors intensify price competition and challenge market positioning, eroding market share and profitability.

- Reputation of Low-Cost Competitors: Budget-friendly competitors attract price-sensitive customers, eroding market share if the company’s value proposition is not effectively communicated.

- Competitors Targeting Product Gaps: Competitors exploiting product gaps capitalize on unmet customer needs, diverting market share and highlighting the need to address product deficiencies.

Corporate Governance

- Privacy Policy:

This privacy policy explains how the Company handles non-public personal data of shareholders who are private individuals, as required by Curaçao law. Personal data may be processed under specific circumstances, including:

- Execution of agreements

- Compliance with regulatory obligations

- Protection of vital interests

- Fulfillment of public obligations

- Representation of the interests of the involved party

Personal data may also be processed with explicit consent from the individual, as indicated in the subscription agreement for prospective Investors.

Personal information is collected through:

- Subscription documents, application forms, due diligence, and other questionnaires provided by shareholders and prospective shareholders via various channels (e.g., in writing, in person, by telephone, electronically). This includes details such as name, address, nationality, passport number, financial and investment qualifications, and objectives.

- Transactions conducted within the Company, including account balances and investments.

Non-public personal information is kept confidential, except as required by law or for operational purposes. The Company may share this information with service providers (e.g., attorneys, accountants, administrators, custodians) for investment administration and servicing, and to satisfy anti-money laundering requirements.

The Company uses safeguards, including physical, electronic, and procedural measures, to protect non-public personal information. Access to personal and account information is restricted to employees who need it for their job responsibilities.

Changes to the privacy policy affecting shareholders will be communicated through a revised policy before implementation.

Corporate Governance Policy

1 | The Company adopts a two-tier corporate governance structure that consists of a supervisory board and a board of directors (de facto “management board”, as hereinafter referred to). |

The supervisory board is responsible for the general policy and strategy of the company and for all actions that are specifically reserved to it pursuant to the listing code of the DCSX or other applicable listing code (in case of a change of listing venue), as well as any code on companies and/or associations (CCA) that may apply, now or in the future, in the Company’s jurisdiction (Curaçao). In addition, the supervisory board is responsible for supervising the management board. The management board exercises all management powers that are not reserved to the supervisory board in accordance with the code(s) referred to above. At least once every five years, the supervisory board should review whether the chosen governance structure is still appropriate, and if not, it should propose a new governance structure to the general shareholders’ meeting. The supervisory board should ensure that this governance structure is correctly implemented in practice. | |

2 | The supervisory board and management board shall remain within their respective remits and interact constructively. |

The supervisory board should pursue sustainable value creation by the company, by setting the company’s strategy, putting in place effective leadership and monitoring the company’s performance in accordance with the Company’s “Vision” and “Mission” as expanded under the section “Company Overview”, especially in terms of economic return. In order to effectively pursue such sustainable value creation, the supervisory board should adopt an inclusive approach that balances the legitimate interests and expectations of shareholders and other stakeholders. The supervisory board should support the management board (including the CEO) in the fulfilment of their duties and should be prepared to constructively challenge the management board (or ‘executive management’, in the event any nonlinearity at management level should apply) whenever appropriate. The supervisory board should decide on and regularly review the company’s medium and long- term strategy based on proposals from the management board (or directly from the CEO or other designated member of the executive management). The supervisory board should approve and regularly review the company’s medium and long-term strategy based on proposals from the management board. The supervisory board should ensure that it approves the operational plans and main policies developed by the management board to give effect to the approved company strategy. The supervisory board should ensure that the company’s culture is supportive of the realisation of its strategy and that the Company’s policy shall not be imposed by unqualified third parties (such as woke and similar movements) at the expense of the Company’s own shareholders and their interests. The supervisory board should monitor that the risk appetite of the management board is compatible with the Company’s strategic objectives as expanded upon in this present Investor Memorandum. More specifically, the supervisory board should, subject to article 14 of the Company’s Deed of Incorporation, recall the management board’s decisions if it considers that, as a result thereof, the Company and its shareholders are exposed, or are at a risk of being exposed, to risks that are not covered by the risk analysis that is expanded upon under the section “Risk (& Mitigants)” of this Investor Memorandum. The supervisory board should appoint and dismiss the Company’s CEO in accordance with, and (in the unlikely event of ambiguity) in the following order of precedence:

The supervisory board should also appoint and dismiss the other members of the management board/executive management, in consultation with the CEO, and taking into account the need for a balanced executive team. “Balanced” for the purpose of this paragraph refers to the criteria set out under article 3 of the present corporate governance principles. The supervisory board should satisfy itself that there is a succession plan in place for the CEO and the other members of the management board/executive managers, and review this plan periodically. In that respect, and until further notice, the following ad interim plan shall apply:

The supervisory board should monitor that the company’s remuneration policy is compliant with the provisions made under the section “Director’s Terms of Employment” in terms of maximum fees and contract duration. The supervisory board should also check if the financial position of the Company allows the remuneration of its management board/executive management. The supervisory board should review the framework of internal control and risk management that is inherent to the Company’s activity of fund manager or other applicable quality under the laws of Curaçao. The supervisory board should take all necessary measures to ensure the integrity and timely disclosure of the company’s financial statements and other material financial and non-financial information in accordance with:

The management board should determine the powers and duties entrusted to the Company’s various managers/executives and demonstrate a clear delegation policy, in close consultation with the CEO. The management board should:

The supervisory board and the management board should agree on whether the executives may accept memberships of other corporate boards. Time constraints and potential conflicts of interests should be considered and balanced against the opportunity for the executive’s professional development. | |

3 | The Company shall have effective and balanced boards in terms of competences. |

Both the supervisory board and (even more) the management board should have a composition appropriate to the Company’s purpose and nature [listed investment company], its operations [finance and, whether or not directly, banking], phase of development, structure of ownership and other specifics. The composition of both boards should be determined so as to gather sufficient expertise in the company’s areas of activity. In that respect, merit and diversity in terms of skills and experience will prevail over diversity in terms of background, age and gender. The supervisory board should include an appropriate number of independent members. “Appropriate number” is to be understood as “at least half”, and subject to the next paragraph. At least two supervisory board members should qualify as independent according to the prevalent criteria (Curaçao CCA or best reasonable alternative, as well as the criteria outlined in the next paragraph). In order to be considered an “independent” supervisory board member, he/she should meet the following criteria:

The minutes of the meeting should summarize the discussions, specify the decision taken and note diverging views expressed by any of the board members. The names of the interveners should only be recorded if specifically requested by them. The supervisory board should meet sufficiently regularly to discharge its duties effectively. The company may organise – where necessary and appropriate – board meetings using video, telephone or internet-based means. The number of supervisory board and board committee meetings and the individual attendance record of board members should be disclosed in a statement, in accordance with:

Supervisory board members should meet at least once a year in the absence of the CEO and the other executives. See also the provisions made under the section “Management Team” with respect to the composition of the Company’s supervisory board and management board/executive management, and in particular the nomination of members proposed by new investors. | |

4 | Where required, external experts and/or special (internal) committees shall assist the supervisory board in the execution of its responsibilities. |

Whenever the need arises, the supervisory board should set up specialised committees in order to advise the board in respect of decisions to be taken, to give comfort to the board that certain issues have been adequately addressed and, if necessary, to bring specific issues to the attention of the board. The respective decision-making should however remain the collegial responsibility of the supervisory board itself. The Company should also monitor that its majority-owned subsidiaries – especially those that operate under the control of a Financial Market Supervising Authority or other Regulator – adopt a similar structure. Strategy formulation should not be referred to any permanent committee. Subject to the other paragraphs of this principle, each committee should meet sufficiently regularly to execute its duties effectively. The Company may organise – where necessary and appropriate – committee meetings using video, telephone or internet-based means. Members of the management board/executive management and senior management (if applicable) may be invited to attend committee meetings to provide relevant information and insights into their areas of responsibility. Each committee should be entitled to meet with any relevant person without any executive being present. | |

5 | The Company shall communicate openly about the appointment of board members, whether or not through third parties that have been designated thereto. |

For any appointment to both the supervisory and management board, the skills, knowledge and experience already present or required on the respective board should be evaluated and, in light of that evaluation, a description of the role and skills, knowledge and experience required should be prepared (also referred to as a “profile”). When dealing with a new appointment (both for the supervisory and management board), the chair of the supervisory board should ensure that, before considering the candidate, the supervisory board has received sufficient information such as the candidate’s curriculum vitae, an assessment of the candidate based on the candidate’s initial interview(s), a list of the positions currently held by the candidate and, if applicable, any necessary information about the candidate’s independence. To the extent of reasonableness, the profile of new board members (1) should be of the same standing as that of the current members. Supervisory board members should be made aware of the extent of their duties at the time of their application, in particular, as to the time commitment involved in carrying out those duties, also taking into account the number and importance of their other commitments. Supervisory board members should not take on more than three board memberships in listed companies. Changes to their other relevant commitments and their new commitments outside the Company should be reported to the chair of the supervisory board as they arise. The supervisory board should ensure that, when considering nominating a former CEO as a supervisory board member, the necessary safeguards are in place so that the new CEO has the required autonomy. If the supervisory board envisages appointing a former CEO as its chair, it should carefully consider the positive and negative implications of such a decision and disclose in a statement why such appointment will not hamper the required autonomy of the CEO. | |

6 | All board members(1) shall demonstrate independence of mind and shall always act in the best interests of the Company. |

Board members(1) should engage actively in their duties and should be able to make their own sound, objective and independent judgements when discharging their responsibilities. Acting with independence of mind includes developing a personal conviction and having the courage to act accordingly by assessing and challenging the views of other board members(1), by interrogating the executives when appropriate in the light of the issues and risks involved, and by being able to resist group pressure. Board members(1) should make sure they receive detailed and accurate information and should spend sufficient time studying it carefully so as to acquire and maintain a clear understanding of the key issues relevant to the company’s business. They should seek clarification whenever they deem it necessary. This recommendation applies specifically to those members that (in spite of being top-tier managers, academicians, magistrates or whichever quality applies) have limited direct or practical experience in the banking industry. Board members(1) should not use the information obtained in their respective capacity for purposes other than for the exercise of their mandate. They should handle the confidential information received in their respective capacity with utmost care and be aware that otherwise penalties may apply. In the event of such a confidentiality violation, all subsequent legal proceedings fall under the competence of the common court of justice with its main office on Curaçao. Supervisory board members should inform the supervisory board of any conflict of interests that could in their opinion affect their capacity of judgement. In particular, at the beginning of each supervisory board or committee meeting, they should declare whether they have any conflict of interests regarding the items on the agenda. Supervisory board members should, in particular, be attentive to conflicts of interests that may arise between the Company, its board members(1), its significant or controlling shareholder(s) and other shareholders. The board members(1) who are proposed by (a) significant or controlling shareholder(s) should ensure that the interests and intentions of this/these shareholder(s) are sufficiently clear and communicated to the supervisory board in a timely manner. In case of doubt as to whether or not a conflict of interest may arise or has arisen, as outlined in the two previous paragraphs, the Company, should seek arbitrary advice from an external auditing firm. This firm, or individual auditor, must be recognised as such by the International Auditing and Assurance Standards Board (IAASB) or by a sound jurisdiction (i.e. an early member state of the European Union). In case of compliance, its/his/her/assessment may be considered a clearance to proceed with or maintain the respective measures/decisions.

| |

7 | In addition to the previous guidelines: The Company shall remunerate members of the supervisory board and management board/executive management fairly and responsibly, however subject to the caps that are imposed for the purpose of the present listing material. See also the provisions made under the section “Management Team”. The Company shall treat all shareholders of a same share class equally and respect their respective rights in accordance with, and (in the unlikely event of ambiguity) in the following order of precedence:

The Company shall conduct regular internal evaluations as to its corporate governance regime. The Company shall report in a transparent manner about any deviation from the above principles, in the unlikely event that this should occur. In case of doubt as to whether:

the Company, should seek arbitrary advice from an external auditing firm. This firm, or individual auditor, must be recognised as such by the International Auditing and Assurance Standards Board (IAASB) or by a sound jurisdiction (i.e. an early member state of the European Union). In case of compliance, its/his/her/assessment may be considered a clearance to:

whichever applies. |

Copyright: Swister’s Software System

The source codes for Swister’s different systems have been lodged with the software division of the Italian Copyright Collection Agency (SIAE).Although Swister currently lacks patents, it would be challenging for competitors to replicate its unique business model and technical features.

The development of Swister’s systems required a total of 818 man-days, indicating that any legitimate replication effort would likely span 18-22 months.

It is also worth noting that Swister’s four systems incorporate approximately 14 features that could be considered patentable in a non-banking context. However, such actions might be perceived as violating industry norms. Swister intends to leverage its innovation through a customary, industry-wide agreement rather than aggressively pursuing patents.